We help you optimize your investment decision process

Bolero Capital Sàrl is an independent financial research firm providing insightful information to professional investors who want to capture opportunities in a variety of market conditions and gain exposure to different asset classes that best fit the prevailing economic environment.

Our main objective is to generate investment ideas and asset allocations based on the macroeconomic environment so as to generate long term value.

For Professional Investors only

Our Services

Deep dive into macro

Economic cycles matter

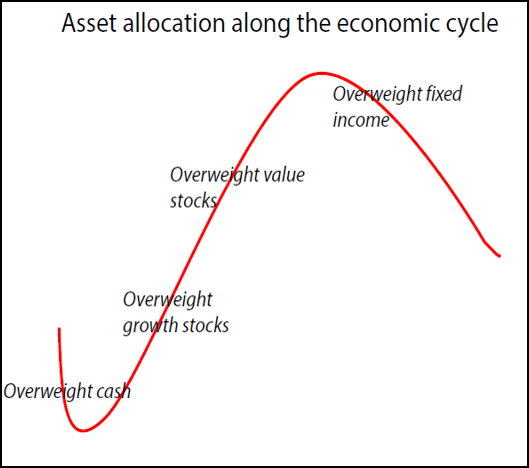

We believe the recognition of the economic cycle, together with asset fundamentals and valuations, should drive investment decisions.

Countries/ sectors follow different cyclical patterns. This means that not all segments of the economy perform well at the same time and may go in and out of favour at separate points in the economic cycle.

We perform a daily monitoring of global macroeconomic data (GDP growth, inflation, interest rates, monetary policies, PMI surveys and other economic indicators) and try to assess their implications for financial markets over the next 6 to 12 months.

The objective is to assess how attractive economic conditions are for taking risk.

Portfolio construction

Convictions - Fundamentals - Flexibility

Our main objective is to provide a dynamic and flexible exposure to the main asset classes (equities, bonds, real estate, both in developed markets and the emerging world) based on our convictions and assessment of the prevailing economic and financial market conditions .

We deliver asset allocation models based on a top down approach combined with qualitative and quantitative analysis of the different asset classes to determine an optimal portfolio in terms of risk/reward without limitation to country, sector, market capitalization and credit.

A reversal in macroeconomic indicators, deterioration in sector and/or company fundamentals, deterioration in credit metrics, valuations significantly above historic norms, as well as rising volatility in the markets are the main triggers for reducing the risk profile of a portfolio and vice versa.

Diversification and risk control

We seeks to minimize specific risks related to a company through a mix of active funds (mainly UCITS funds) and passive funds (Exchange Traded Funds).

Fund selection

Quality and consistency

We cover more than 200 funds selected on both quantitative and qualitative criteria, with a mix of big houses and smaller boutiques.

We target funds offering consistent and above average performance over the long term in their respective asset class with controlled volatility. In depth analysis of the investment style, the investment process, and the risk profile of the funds.

We hold regular meetings with fund managers, via conference calls, fund events, conferences.

ESG considerations

We tend to favour funds that integrate an active ESG (Environmental, Social Responsible and governance) overlay as a risk management tool.

We view the ESG component as a tool to identify the long term winners in a global economy that is facing increasing challenges in terms of climate protection, sustainability. The ESG component improves the understanding of the businesses we invest in and the risks they are exposed to.

ABOUT US

Marie-Christine LAMBIN

Founder - Managing Director

Bolero Capital Sàrl is an independent financial research firm founded by Marie-Christine, a seasoned asset management with an international career with major banks and family office in Luxembourg and Switzerland.

Graduated from the University of Louvain-La-Neuve (Belgium) Marie-Christine Lambin has more than 35 years’ experience in financial market analysis and portfolio management.

In August 2013, she launched the MC Bolero Global Allocation Fund. She managed the fund until May 2019 with the aim to provide investors with a one-stop investment solution to changing market conditions.

Marie-Christine continues to provide asset allocation recommendations to a wide variety of clients who want to gain exposure to the main asset classes (equities, bonds, real estate, both in developed markets and the emerging world) while seeking a dynamic and flexible exposure to risk according to market conditions.

Marie-Christine received several awards as fund manager, fund selector and asset allocator.